Tally Prime Training by Experts

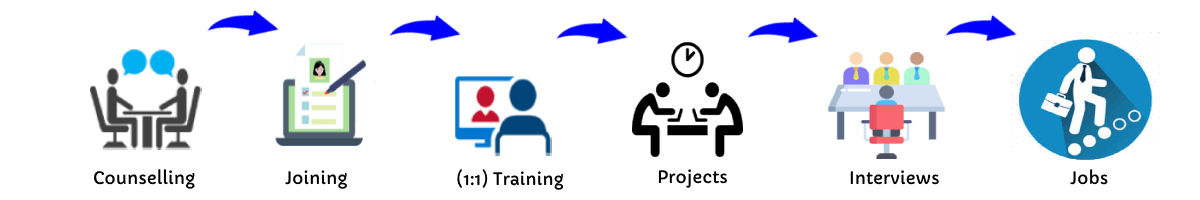

Our Training Process

Tally Prime - Syllabus, Fees & Duration

Comprehensive Syllabus: Dive deep into every aspect of Tally Prime with our detailed and structured syllabus:

Introduction to Tally Prime

Overview and Installation

Tally Prime Interface and Features

Accounting Fundamentals

Basics of Accounting

Chart of Accounts

Creating and Managing Ledgers and Groups

Inventory Management

Stock Groups, Categories, and Items

Units of Measurement

Purchase and Sales Management

Taxation

GST (Goods and Services Tax) Configuration

GST Invoicing and Reporting

TDS and TCS Management

Payroll Management

Employee Details and Salary Structure

Attendance and Leave Management

Payroll Reports

Banking and Reconciliation

Bank Reconciliation

E-Payments and Cheque Management

Advanced Features

Multi-Currency Transactions

Data Security and Backup

MIS Reporting and Analysis

Real-Time Applications

-

Handling Multiple Companies

Audit and Compliance

Financial Year-End Processes

-

Training by Industry Experts: Learn directly from experienced professionals who bring real-world insights to every session. Our trainers have hands-on expertise in Tally Prime and financial management.

Live Online Classes: Attend live, interactive sessions from the comfort of your home. Get personalized attention and clarify doubts instantly during classes.

-

Real-Time Projects and Internships: Work on actual business scenarios and projects to gain practical experience. Our internships offer exposure to:

-

Inventory Management for SMEs

GST Filing for Retail Businesses

Payroll Processing for Corporates

-

This syllabus is not final and can be customized as per needs/updates

Designed by industry experts, this course covers everything from the basics of accounting to advanced functionalities in Tally Prime, such as GST compliance, payroll management, and MIS reporting. This course caters to students, business owners, and professionals looking to enhance their accounting skills. .

By the end of the course, you will be proficient in using Tally Prime for day-to-day business operations and compliance. Join today and attend a free trial class to experience our expert-led training firsthand. Earn an industry-recognized certification, access lifetime learning resources, and receive placement assistance to kickstart your career. Our Tally Prime course is a complete guide for anyone aspiring to excel in financial management and business accounting.

Through interactive live classes, hands-on training, and real-time projects, you will gain practical knowledge of inventory management, financial data security, and reconciliation processes. You will also learn to handle multi-company operations and financial year-end adjustments.

Designed by industry experts, this course covers everything from the basics of accounting to advanced functionalities in Tally Prime, such as GST compliance, payroll management, and MIS reporting. This course caters to students, business owners, and professionals looking to enhance their accounting skills. .

By the end of the course, you will be proficient in using Tally Prime for day-to-day business operations and compliance. Join today and attend a free trial class to experience our expert-led training firsthand. Earn an industry-recognized certification, access lifetime learning resources, and receive placement assistance to kickstart your career. Our Tally Prime course is a complete guide for anyone aspiring to excel in financial management and business accounting.

Through interactive live classes, hands-on training, and real-time projects, you will gain practical knowledge of inventory management, financial data security, and reconciliation processes. You will also learn to handle multi-company operations and financial year-end adjustments.