QuickBooks Training by Experts

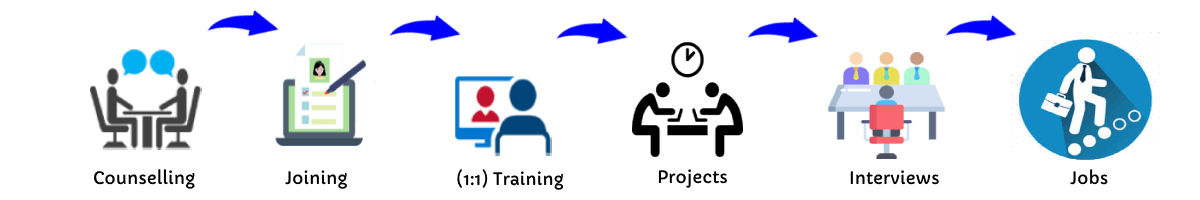

Our Training Process

QuickBooks - Syllabus, Fees & Duration

QuickBooks Training Syllabus – 30 Hours

Module 1: Introduction to Accounting & QuickBooks (3 hours)

-

Basics of accounting and financial terms

-

Introduction to QuickBooks Desktop & Online

-

Installation & setup of QuickBooks

-

Interface overview: dashboard, menus, settings

Module 2: Company Setup and Configuration (3 hours)

-

Creating a company file

-

Editing company preferences

-

Setting up fiscal year and currency

-

Backing up and restoring company files

Module 3: Chart of Accounts & Items (3 hours)

-

Understanding chart of accounts

-

Adding/editing accounts

-

Creating product and service items

-

Categorizing income and expenses

Module 4: Customers & Sales Management (4 hours)

-

Creating and managing customer profiles

-

Creating estimates, invoices, and sales receipts

-

Applying payments and handling partial payments

-

Handling sales returns and issuing credit memos

Module 5: Vendors & Expense Management (4 hours)

-

Creating vendor profiles

-

Recording purchases and bills

-

Paying bills manually or automatically

-

Tracking expenses and refunds

Module 6: Inventory & Asset Management (2 hours)

-

Setting up inventory items

-

Managing stock and reorder levels

-

Non-inventory and service items

-

Asset tracking and adjustments

Module 7: Bank Transactions (3 hours)

-

Linking and managing bank accounts

-

Reconciling accounts

-

Importing bank statements

-

Handling deposits and transfers

Module 8: Payroll & GST (4 hours)

-

Overview of payroll in QuickBooks

-

Setting up employee profiles

-

Calculating salaries, deductions, and taxes

-

Enabling and managing GST/VAT (India-specific)

Module 9: Financial Reporting & Analysis (3 hours)

-

Generating key reports: Profit & Loss, Balance Sheet, Cash Flow

-

Customizing reports

-

Exporting and printing reports

-

Basic financial analysis

Module 10: Project Work & Live Use Case (3 hours)

-

Create a sample business in QuickBooks

-

Perform full-cycle transactions (sales, purchases, payroll, GST)

-

Generate end-to-end reports

-

Troubleshooting and Q&A

Additional Features:

-

Multi-user access & roles

-

Data security & user permissions

-

QuickBooks mobile & cloud usage

-

Tips for freelancers and small businesses

Outcome:

By the end of the 30-hour course, students will:

-

Be proficient in managing small to medium business accounts using QuickBooks

-

Gain hands-on experience through live projects

-

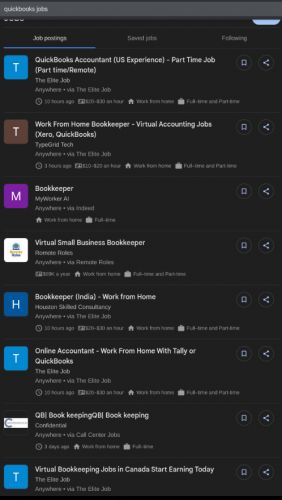

Be ready for jobs in accounting, bookkeeping, or freelancing

-

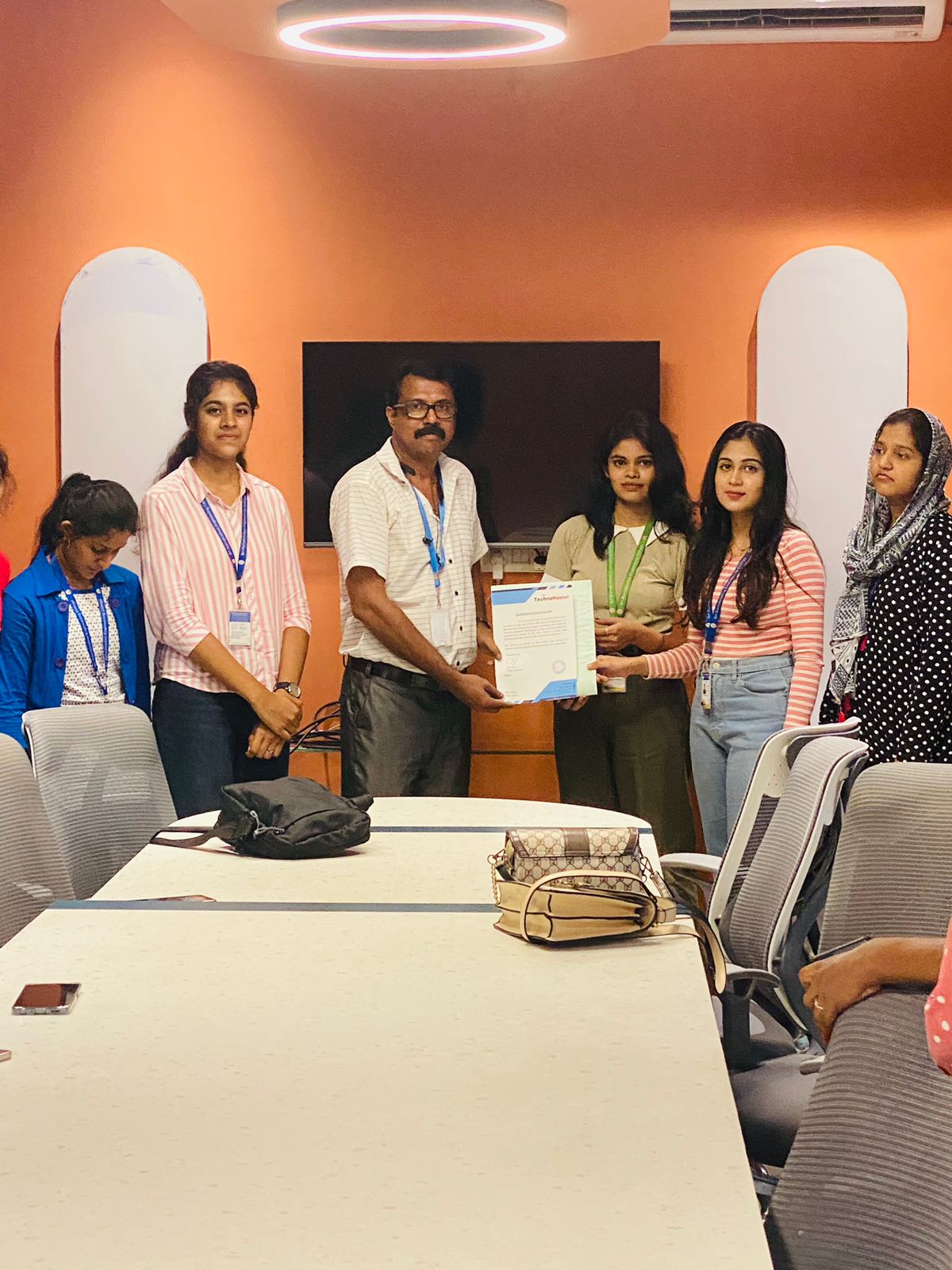

Receive certification and internship support (if provided)

Download Syllabus - QuickBooks

This syllabus is not final and can be customized as per needs/updates

You’ll also gain access to a live internship, enabling you to apply your skills in a working environment and enhance your resume.

With certification and placement assistance included, this course is ideal for those looking to build a successful career in accounting, finance, or business administration using QuickBooks Desktop or Online versions. QuickBooks Training Course by Technomaster is a career-focused program designed to equip you with practical accounting and financial management skills using one of the world’s most widely used bookkeeping tools. .

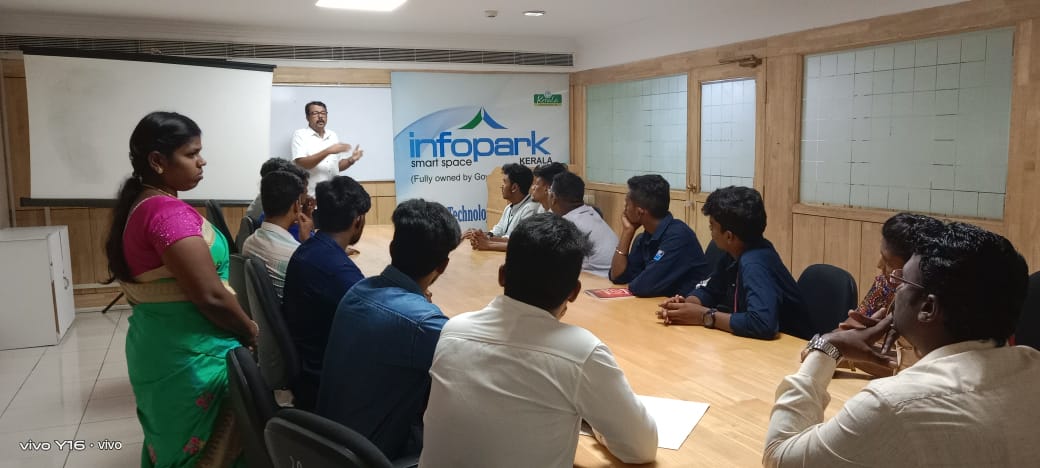

Taught by experienced industry professionals, the training includes real-time projects, live online or offline sessions, and hands-on exercises tailored to real-world business needs. Whether you're a student, entrepreneur, finance professional, or job seeker, this course covers everything from setting up a company file to managing sales, expenses, payroll, GST, and generating financial reports.

You’ll also gain access to a live internship, enabling you to apply your skills in a working environment and enhance your resume.

With certification and placement assistance included, this course is ideal for those looking to build a successful career in accounting, finance, or business administration using QuickBooks Desktop or Online versions. QuickBooks Training Course by Technomaster is a career-focused program designed to equip you with practical accounting and financial management skills using one of the world’s most widely used bookkeeping tools. .

Taught by experienced industry professionals, the training includes real-time projects, live online or offline sessions, and hands-on exercises tailored to real-world business needs. Whether you're a student, entrepreneur, finance professional, or job seeker, this course covers everything from setting up a company file to managing sales, expenses, payroll, GST, and generating financial reports.